How to Use YNAB for Beginners– See Exactly What I Do!

If it feels like your finances are spinning out of control, the absolute FIRST thing you have to do is to figure out what you're actually spending. It sounds simple, but it's absolutely not, LOL! And I'm sure you already know this if you're at the beginning of sorting out some sort of budget!

If you haven't heard of it, YNAB stands for You Need A Budget. YNAB is my secret to keeping my budget in check, and the best part is it only takes me about 10 minutes a WEEK!! Less time budgeting– yay! If you want to see exactly what I do on a daily and weekly basis for budgeting in YNAB, keep reading, or check out the video here.

There are all kinds of different budgeting systems. I'll tell you why YNAB has worked best for me out of all that I've tried:

- It's digital. Soooo many of my expenses are digital. I pay bills online or on autopay. I also use credit and/or debit cards almost exclusively. I rarely use cash. So having a cash system just isn't practical for me.

- It's also mobile. I use it a ton on my phone, especially for quickly categorizing expenses as they come out of my account.

- It's fast. It literally takes me about 2 minutes each weekday to categorize expenses. It takes me an extra 5-10 minutes each month to set the budget for the coming month.

- There is some extra setup time when you first start, but even that only takes about 20-30 minutes. Everything is as automated as it could possibly be, and all of that automation saves major time! I never have to re-do anything!

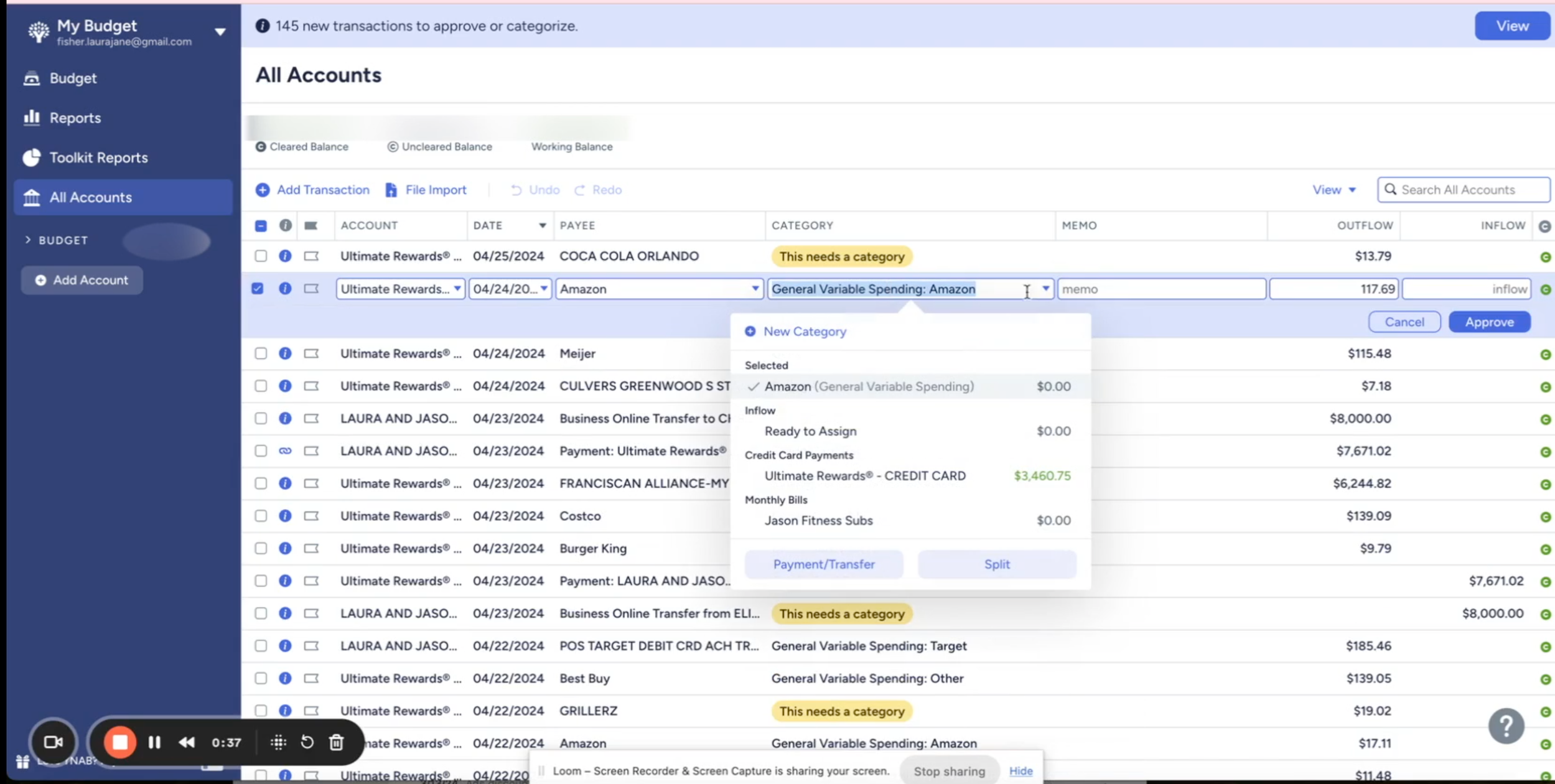

Categorizing Expenses

The biggest part of keeping up with YNAB is just categorizing your expenses as they come in. I do this a little bit differently than some. Here are the categories I have:

- monthly bills

- general spending

- various sinking funds (saving for specific purposes)

- eating out

- giving

- savings

- investing

- taxes

Most people would split their general spending into somethign like this:

- food/groceries

- cleaning products

- toiletries

- clothing

- home decor

I find that the more categories I have, the more complicated (and less quick and easy!) things become. If I'm going to have a hope of sticking with anything, it really needs to be fast and easy at this point in my life! So what I ended up doing instead for general spending is to split it into stores– like Meijer, Target, Walmart, etc.

YNAB allows you to get as into-the-weeds as you'd like. So I could take my Target receipt and put $20 into clothing, $50 into groceries, $60 into home decor….but then I have to keep my receipt, do the math, split it all out, etc. It just takes a lot of time. I've also found that I don't really need to know what I'm spending in each category. If you do, you can absolutely track that. But what matters most to me is that I'm not overspending as a whole. I need to spend less than I make, LOL! But if one week I spend more in clothes and less in toiletries, it really doesn't matter to me.

Categorizing by stores is just so simple and very black-and-white. It takes zero thought to know where it goes, and because of the automation, YNAB categorizes this for me already, and all I have to do is go in and approve it all at once, and I'm done! I can still see which store I spend the most at, and this can be helpful. Target tends to be a “fun” store, so while I may buy some groceries there, if I notice my spending is totally out of control at Target, groceries are most likely not the problem, LOL!

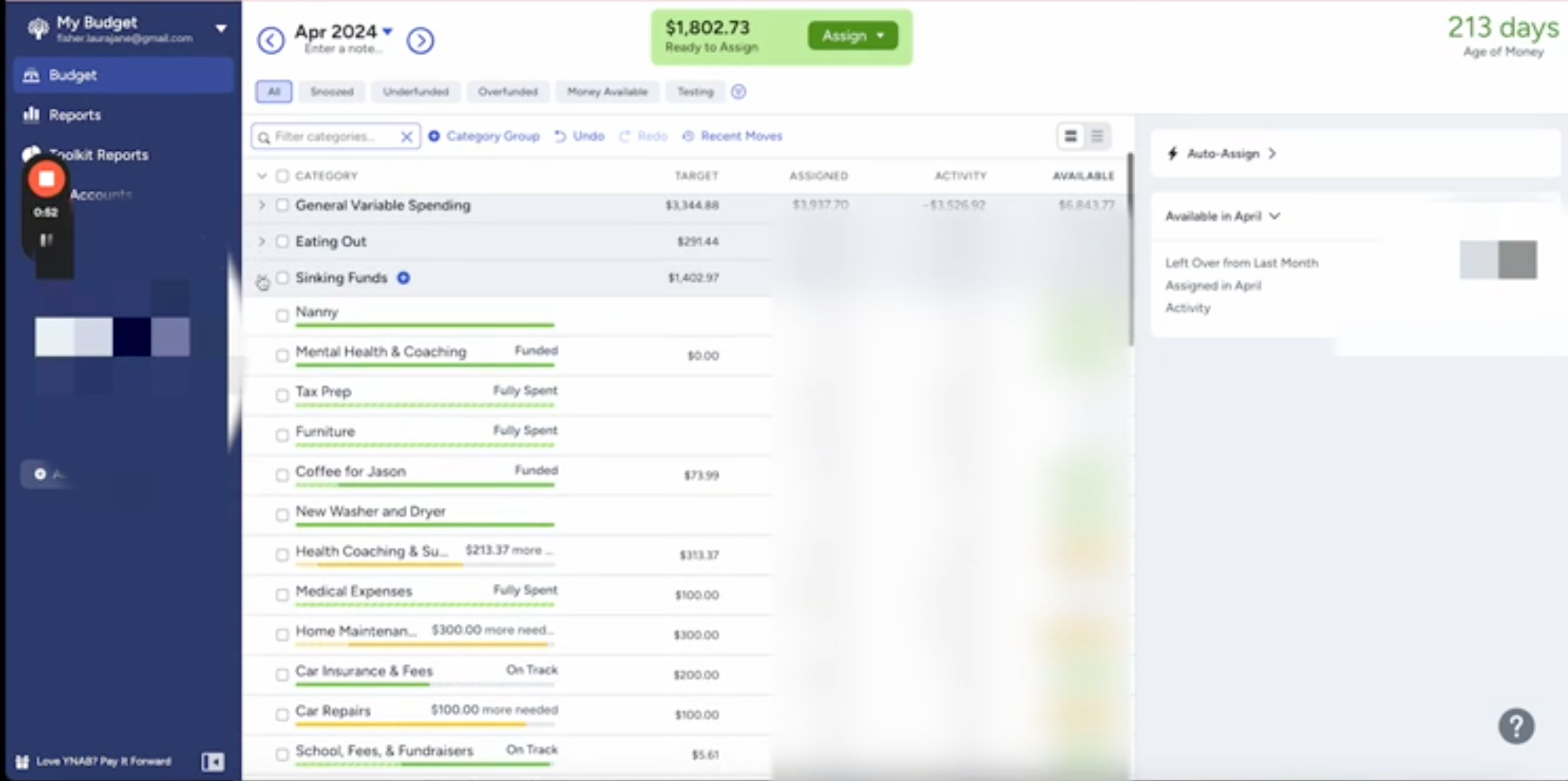

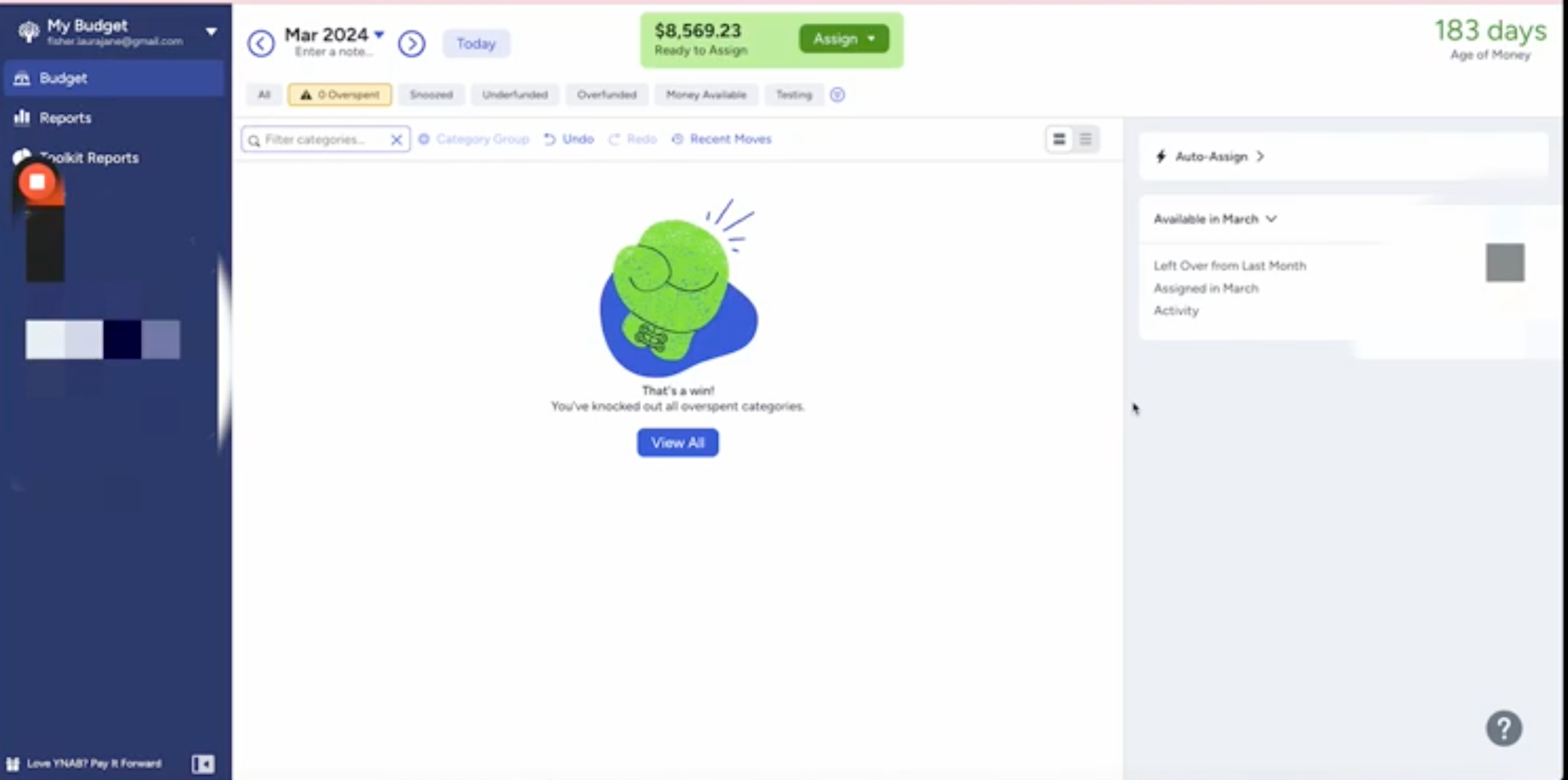

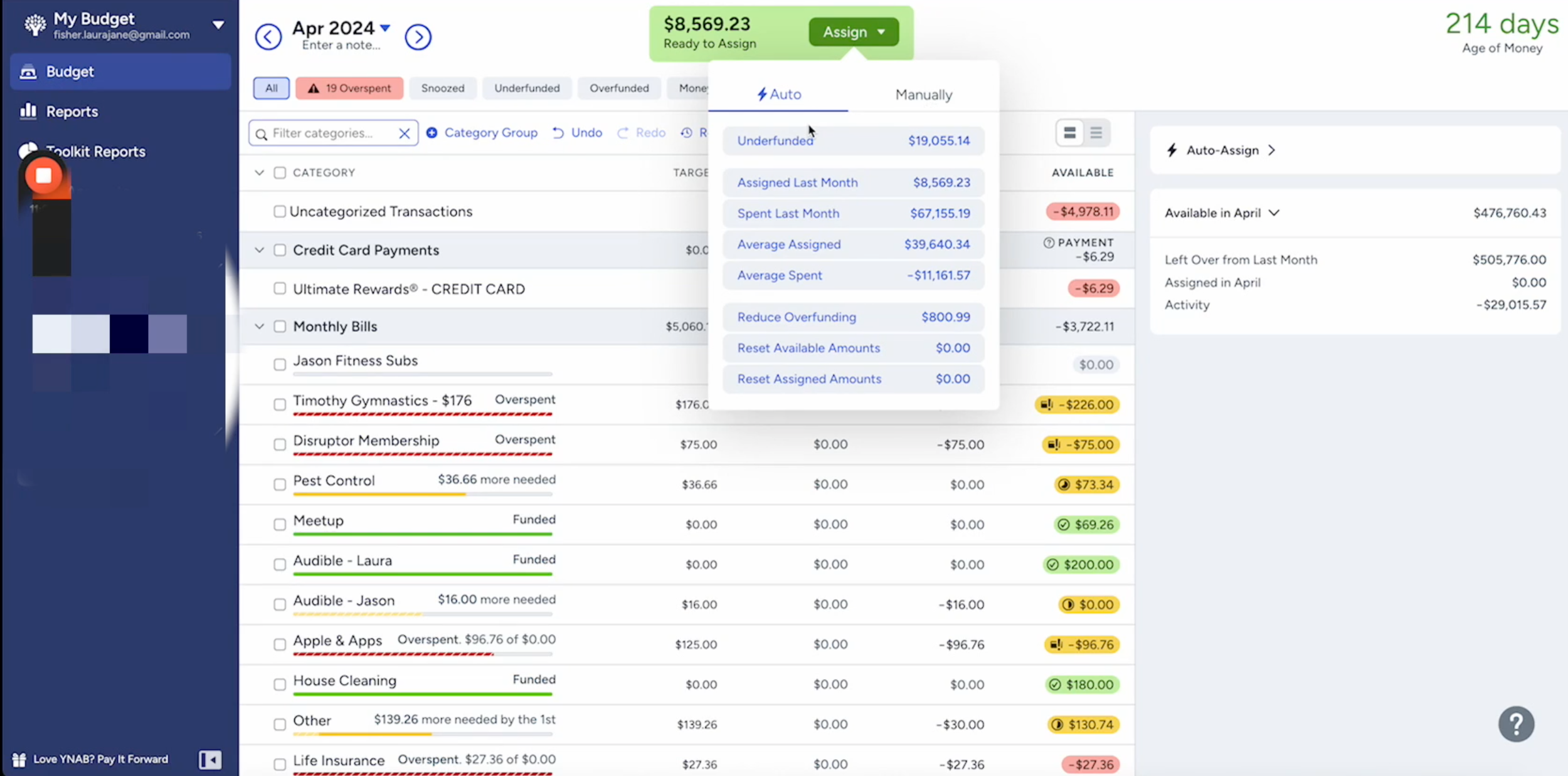

Planning Your Budget

At the end of each month, I need to “clean up” the budget and then set the budget for the coming month. If I overspent in any one category, I need to move money from another category to cover it. I like to keep a “Lifestyle” category for this purpose. It's like my “oops” fund. Sometimes it's used for things we need, like a dental bill, or sometimes I use it because we wanted to do something fun like an unplanned weekend trip. But you don't have to do this if you want to be more detailed with your planning than I do. I just like building in some flexibility.

Get a Month Ahead (If You Can)

This is one of the foundational principles of YNAB. They really promote getting a full month ahead so that when you start the month, you're using the money you already have that came in last month. This can be especially helpful if you don't get a stable paycheck. This could be for all sorts of reasons:

- You work on commission.

- Your job has some unpredictable overtime.

- Your hours aren't the same from one week to the next.

Basically, if your check isn't exactly the same every month or every week, then you could really benefit from getting a month ahead. This way you know exactly how much money you have to work with, and you aren't guessing what will come in!

Getting a month ahead isn't always a short/easy process. It can take several months (or more) to live under your means enough to get a month ahead. It is so worth it, though, and it gives you a lot of peace of mind if you do have an unstable income.

Targets

This is probably the single most confusing thing about YNAB. It was something I didn't really understand at first, but once it clicked, things made so much more sense! Targets are basically savings goals. You might have a specific goal or a target balance you're trying to hit. So, maybe you're saving for a vacation that's going to cost $2600. Once you hit that target, YNAB automatically stops you from funding that further. Or if your emergency fund is fully funded at $5000, once you hit that goal, no more money goes in.

One thing I would recommend though, is that if you have a car payment, continue paying that “payment” into a sinking fund so hopefully you can pay cash for the next car and not have to pay out money in interest next time.

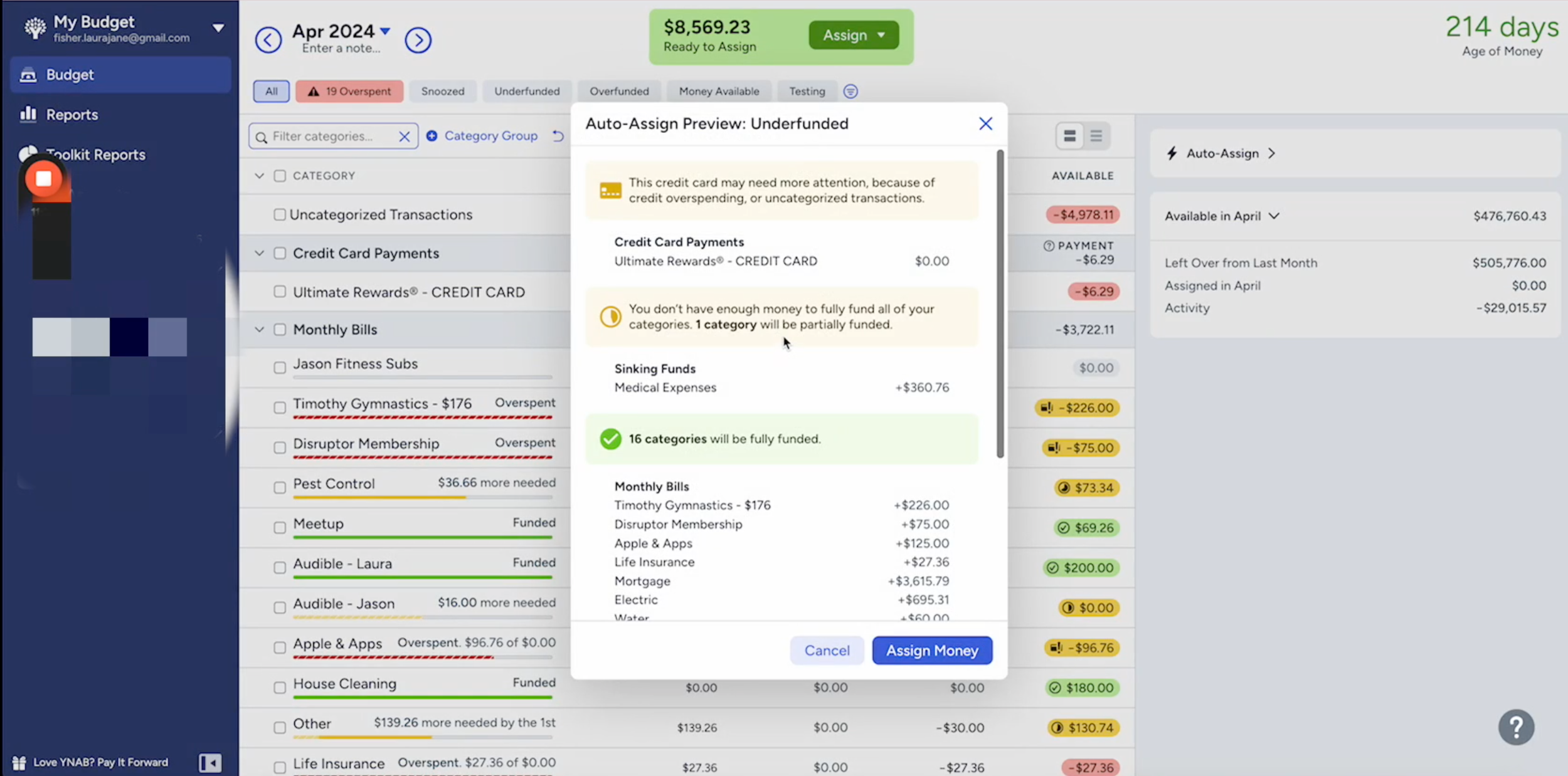

If you happen to not have enough to fund all your targets at the rate you normally contribute, then YNAB will tell you. You can then decide to skip funding or pull it from somewhere else. Sometimes it's okay to stop funding. If we have a good cushion in our medical fund, it's okay to skip a couple months. But if you do this indefinitely, it will eventually come back to bite you, of course.

I love how effective YNAB is for budgeting. But most important– it's fast and easy to use!! A system only works if you use it, so anything we can do to make it more likely that we'll actually do something, the better! This is by no means a tutorial on how to use YNAB. They actually have GREAT videos for that on their own site and YouTube channel. But I get soooo many questions on budgeting that I thought it was time to tell you all what I use and why it works for me. Hopefully YNAB can help some of you as well!

Organization that actually sticks for busy, happy lives

Copyright 2026, Get Organized HQ.

Copyright 2026, Get Organized HQ.

Cynthia Fowles Says

I love the spray Calamine lotion. A good alternative in from Gold Bold. It is their maximum itch lotion. We get the tiny ankle biting mosquitoes and these are worse than the regular mosquitoes. For some reason they love me.